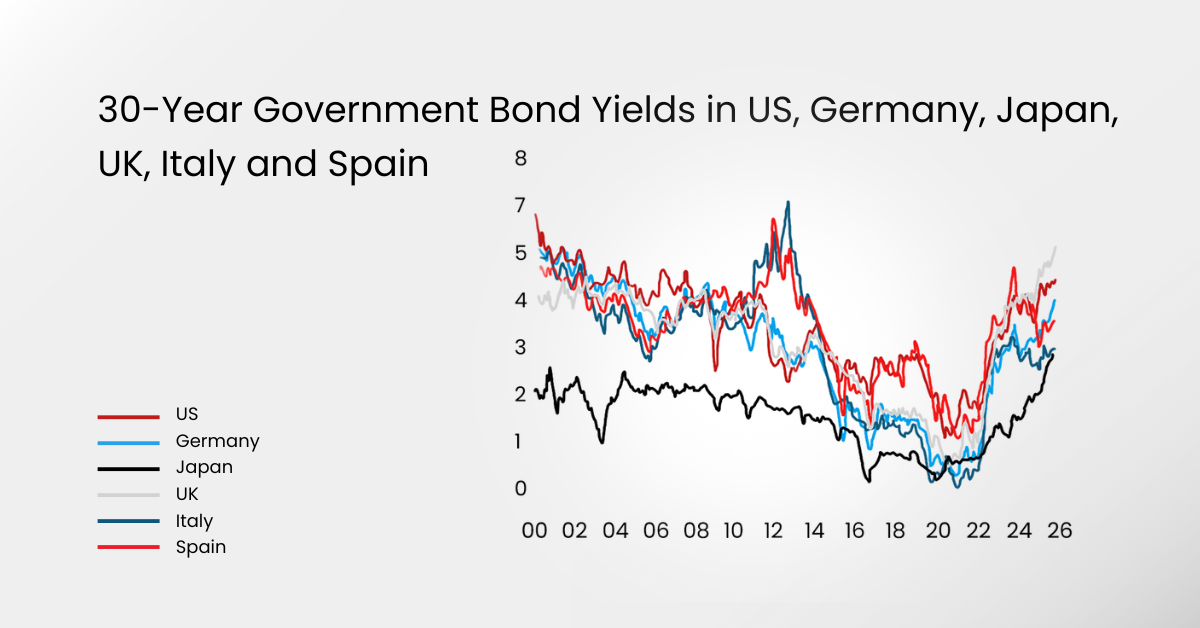

The global bond market is sending a warning. Across the US, UK, Europe, and Asia, long-term bond yields are rising, even as central banks cut short-term policy rates.

This unusual divergence has traders asking one big question: how long can stocks ignore it?

Why Yields Are Rising Despite Rate Cuts

At first glance, it sounds contradictory. Central banks are easing policy, yet long-term yields continue climbing.

The UK’s 30-year gilt yield just surged to 5.69%, its highest level since 1998.

In the US, the 10-year Treasury yield remains elevated near multi-year highs, despite expectations of September rate cuts.

This isn’t just a local issue, it’s global.

Investors are demanding higher returns, pricing in fiscal risks, sticky inflation, and higher future deficits. In other words, bond markets are focused less on what central banks are doing today and more on what governments will need to finance tomorrow.

Global Yields on the Rise

The chart above shows just how widespread this move really is. Yields across the US, UK, Germany, Japan, Italy, Spain, and France have been climbing sharply since 2022.

This is happening even as central banks shift toward cutting policy rates.

For traders, this divergence sends a clear signal: bond markets are demanding higher returns because fiscal risks, debt loads, and investor uncertainty are outweighing monetary easing.

When the global tide moves together like this, equities can’t ignore it for long.

Fiscal Stress Is Driving the Trend

Monetary policy isn’t the main culprit here. Fiscal policy is.

Take the UK as an example. Government spending is projected to cross 60% of GDP in the coming years, while revenues remain below 40%, according to official forecasts. That imbalance forces higher borrowing, which pushes yields up, regardless of what central banks want.

The same story is unfolding across Europe, the US, and Japan. Rising deficits, aggressive issuance of government debt, and persistent investor skepticism are driving up long-term rates even in easing cycles.

Why Stocks Care About Bond Yields

For equity markets, rising yields are never neutral. Higher yields increase the discount rate used to value future earnings, which directly pressures stock valuations.

Growth stocks, particularly in tech, are the most exposed since their valuations rely heavily on projected earnings. Meanwhile, value sectors like energy, banks, and commodities often hold up better. But if yields keep climbing, the pressure broadens across the board.

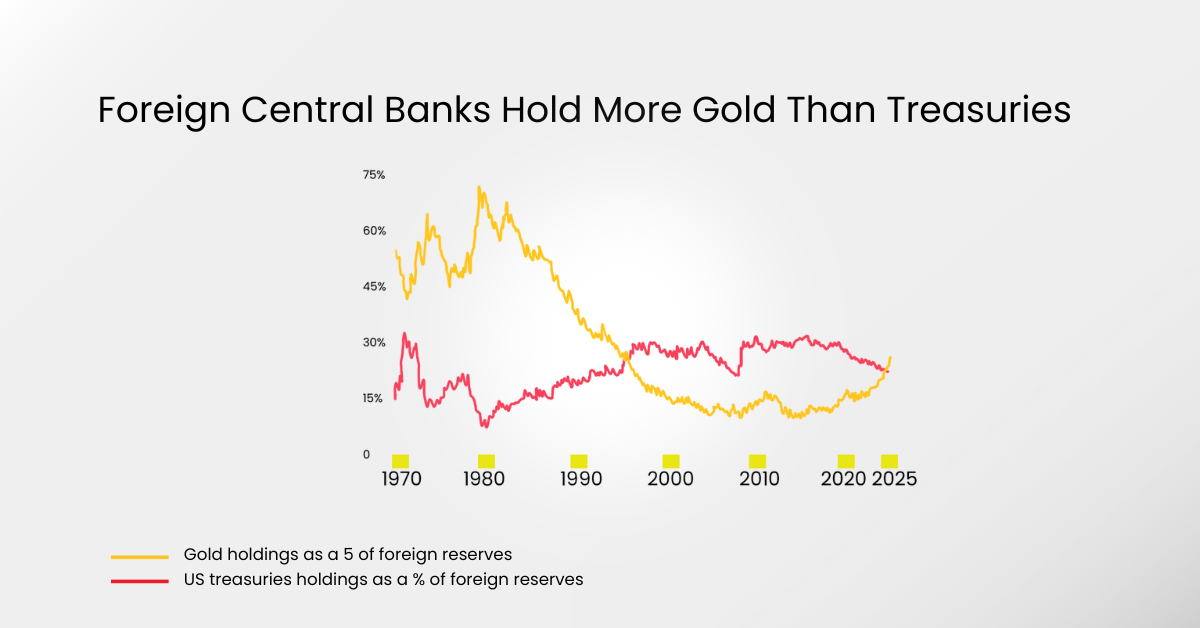

This dynamic is already shifting investor positioning. Hedge funds and institutional investors remain cautious on US stocks heading into September, historically one of the most volatile months for equities. Many are reallocating toward commodities, cash, and non-US markets.

Safe Havens Are Back in Play

The recent breakout in gold above $3,500 isn’t a coincidence. With fiscal risks mounting and real yields staying high, traders are looking for alternatives to equities and government debt. Central banks globally have also been increasing their gold reserves, which adds another tailwind for the metal.

This highlights a broader theme: in an environment where bonds aren’t offering stability, capital seeks safety elsewhere. That rotation matters for traders watching both equities and commodities closely.

What Traders Could Watch Next

1. The Yield Curve

If the curve steepens further, it signals bond markets expect elevated long-term risks.

2. September’s FOMC Meeting

A dovish Fed could accelerate short-term volatility across all asset classes.

3. Earnings Season

If higher yields start hitting company profits, equities may need to be repriced.

4. Safe-Haven Flows

Keep an eye on gold and the US dollar. They’ll often move ahead of equities during risk-off periods.

Key Takeaways

Global bond yields are rising, even as central banks cut rates. That divergence isn’t noise, it’s a signal.

Fiscal stress, heavy borrowing, and persistent inflation concerns are forcing markets to reprice risk.

For equities, this isn’t an immediate collapse warning, but ignoring the bond market has historically been expensive.

When global yields rise together, it often marks a turning point in broader investor sentiment. If global yields keep climbing, the real question is not if equities react, but how fast.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.