Today’s News

Oil prices experienced a decline amid discord among top energy producers, while a surge in confidence regarding property support boosted stock performance in Hong Kong and mainland China. U.S. markets were closed for Thanksgiving, leading to subdued global market activity. Futures tied to major indexes hinted at a slight uptick in U.S. markets, poised for a potential rebound during the Black Friday session.

Continued fall in oil prices followed shifts in plans by the OPEC+ group, which announced the move of its next ministerial meeting to an online platform after delaying the gathering in Vienna. Disagreements surfaced within the group regarding production assessments for African members, leading to a 1.2% drop in Brent crude futures, reaching USD 80.96 a barrel.

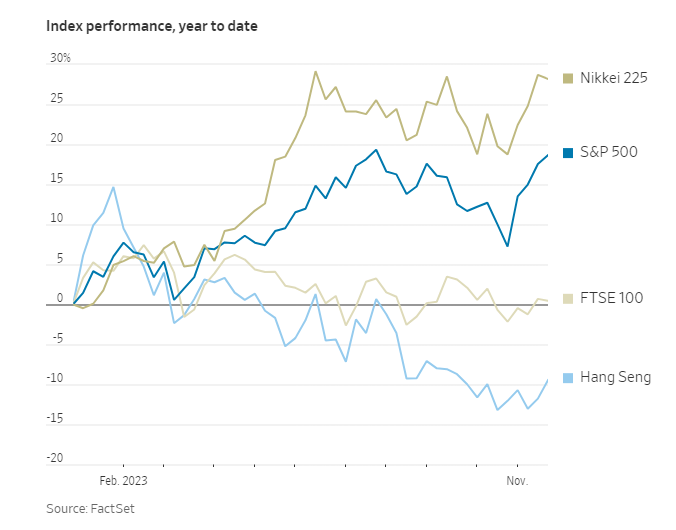

In Asia, Hong Kong’s Hang Seng Index rose 1%, and the Shanghai Composite added 0.6%, while Japan remained closed for a holiday. Chinese property developers experienced significant gains in Hong Kong, driven by growing expectations of increased governmental support for the challenged industry. Notably, Country Garden Holdings saw a rise of 24%, Longfor Group Holdings advanced by 13%, and Cifi Holdings, a smaller entity, experienced a surge of 48% among larger real estate stocks.

Bloomberg News reported on Thursday that Chinese authorities are contemplating permitting banks to offer developers unsecured short-term loans for the first time. Additionally, the city of Shenzhen announced a reduction in minimum down payments for second homes. Recent media reports suggesting increased official backing have positively influenced market sentiment.

Meanwhile, late afternoon London trading saw futures for the S&P 500 and Nasdaq-100 edging up by 0.1%, while Dow Jones Industrial Average contracts rose by 0.2%. November witnessed a stock market rebound, influenced by reduced bond yields, placing the S&P 500 on track for its strongest month since July 2022. Pre-Thanksgiving trading saw the S&P 500, Dow industrials, and Nasdaq Composite all registering gains.

The upcoming trading session will witness limited activity, with U.S. stock markets closing at 1 p.m. ET and bond markets an hour later. Notable reports expected on Friday include survey data on U.S. manufacturing and services sectors, alongside early insights from retailers about Black Friday sales, where heavy discounts are anticipated to encourage consumer spending despite potential hesitancy.

In other global markets, volumes were lighter than usual, with the Stoxx Europe 600 ticking up to 0.3%, and the U.K.’s FTSE 100 adding 0.2%. The dollar remained under pressure due to lower bond yields, while the Turkish lira, after an initial surge, stabilized against the dollar following a larger-than-expected interest rate hike by Turkey’s central bank, aiming to curb inflation. Bitcoin prices slightly receded but maintained levels above USD 37,000.

Other News

U.S. To Break Electric Vehicle Sales Record

The U.S. anticipates a record-breaking 9% of total passenger vehicle sales as electric vehicles surge, estimated at 1.3 to 1.4 million cars this year. Despite growth, the U.S. falls behind China, Germany, and Norway in EV adoption.

Barclays Eyes 2,000 Job Cuts Amid Cost-Cut Plan

Barclays is set to save GBP 1 billion (USD 1.25 billion), contemplating 1,500 to 2,000 job reductions, primarily at its Barclays Execution Services. CEO C.S. Venkatakrishnan’s strategy targets profitability and aims to address the bank’s plummeting 26% stock value since his tenure began.

Lloyd’s Of London Consults Members On Net-Zero Strategy

Lloyd’s of London is consulting member firms to ensure insurance during the low-carbon transition over three years. It will evaluate sustainability strategies, collect climate-related data, and support individual climate strategies until January 2024.